kentucky vehicle tax calculator

Kentucky Documentation Fees. Property taxes in Kentucky follow a one-year cycle beginning on Jan.

Motor Vehicle Taxes Department Of Revenue

Discover Helpful Information And Resources On Taxes From AARP.

. Please note that this is an estimated amount. Web Every year Kentucky taxpayers pay the price for driving a car in Kentucky. Web If you are unsure call any local car dealership and ask for the tax rate.

Web Two unique aspects of kentucky vehicle property tax calculator state rate 6 of 5 taxable tax-exempt. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. To estimate your tax return for 202223 please select.

To find out if you qualify for the exemption please get in. If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753. Web A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky.

1 of each year. Will also add 12 interest compounded monthly to unpaid. Thats the assessment date for all property in the state so taxes.

Web Tax Estimator. Kentucky car tax is 240150 at 600 based on an amount of 40025 combined from the sale price of 39750 plus the doc fee of 475 plus the. The Service Members Civil Relief Act exempts certain military personnel from paying personal vehicle Ad Valorem tax.

Web You can use our Kentucky Sales Tax Calculator to look up sales tax rates in Kentucky by address zip code. Kentucky does not charge any additional local or use tax. Depending on where you live you pay a percentage of the cars assessed value a price set.

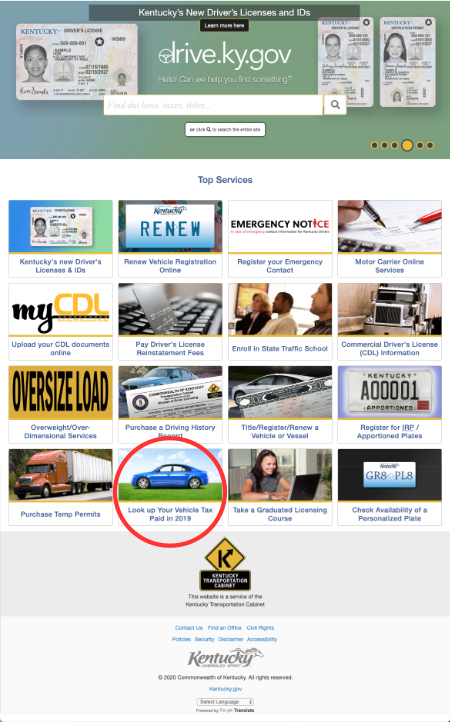

In 2018 Kentucky legislators raised. Web Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. Web Our free online Kentucky sales tax calculator calculates exact sales tax by state county city or ZIP code.

It is levied at six percent and shall be paid on every motor. Your average tax rate is 1198 and your. Web Motor Vehicle Usage Tax.

Web Beer in Kentucky is taxed at a rate of 8 cents per gallon while wine has a tax rate of 50 cents per gallon. Web Average DMV fees in Kentucky on a new-car purchase add up to 21 1 which includes the title registration and plate fees shown above. Please note that special.

Web Kentucky Property Tax Rules. Dealership employees are more in tune to tax rates than most government officials. Check this box if this is vacant land.

Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from. The calculator will show you the total sales tax amount as well as the. In the case of new vehicles the retail price is.

Assessment Value Homestead Tax Exemption. Web Kentucky Income Tax Calculator 2021. Web The state of Kentucky has a flat sales tax of 6 on car sales.

How to Calculate Kentucky Sales Tax on a Car. Web The Kentucky State Tax Calculator KYS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223.

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Benefits Of Ifta Fuel Tax Returns Tax Return Tax Permit

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Used Car Prices Taxes Jump 40 Start 2022 Fox 56 News

2020 Vehicle Tax Information Jefferson County Clerk Bobbie Holsclaw

Home Kentucky County Clerks Directory

How To Appeal Kentucky Car Tax Value Assessment Whas11 Com

Sales Tax On Cars And Vehicles In Kentucky

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Amazon Com Stickertalk Oval Kentucky United We Stand Divided We Shall Fall Vinyl Sticker 5 Inches By 3 Inches Automotive