sales tax in tampa florida 2020

The December 2020 total local sales tax rate was 8500. This includes the rates on the state county city and special levels.

What is the sales tax in Pinellas County FL.

. This is the total of state county and city sales tax rates. What is the sales tax rate in Tampa Florida. Sales Tax Rate Tampa Fl 2020.

Tampa collects the maximum legal local sales tax. The current total local sales tax rate in Tampa FL is 7500. The minimum combined 2022 sales tax rate for Tampa Florida is.

Tampa collects the maximum legal local sales tax. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. If you are facing a sales tax audit the Florida sales tax lawyers from the Law Offices of Moffa Sutton Donnini PA.

For a more detailed breakdown of rates please refer to our table below. The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665. In this scenario Florida will collect six percent sales tax on 31000 which is the advertised price of.

As a matter of basic fairness its time for Florida to collect internet sales taxes that are owed but go unpaid. Motor vehicle sales tax rates by state as of december 16 2020. Hillsborough County residents currently pay a 15 discretionary sales surtax on the first 5000 of taxable value.

Floridas general state sales tax rate is 6 with the following exceptions. 2020 rates included for use while preparing your income tax deduction. Ultimately you pay 28000 for the car saving 12000 off the original price.

The sales tax rate in Tampa Florida is 75. Groceries and prescription drugs are exempt from the Florida sales tax. There is no applicable city.

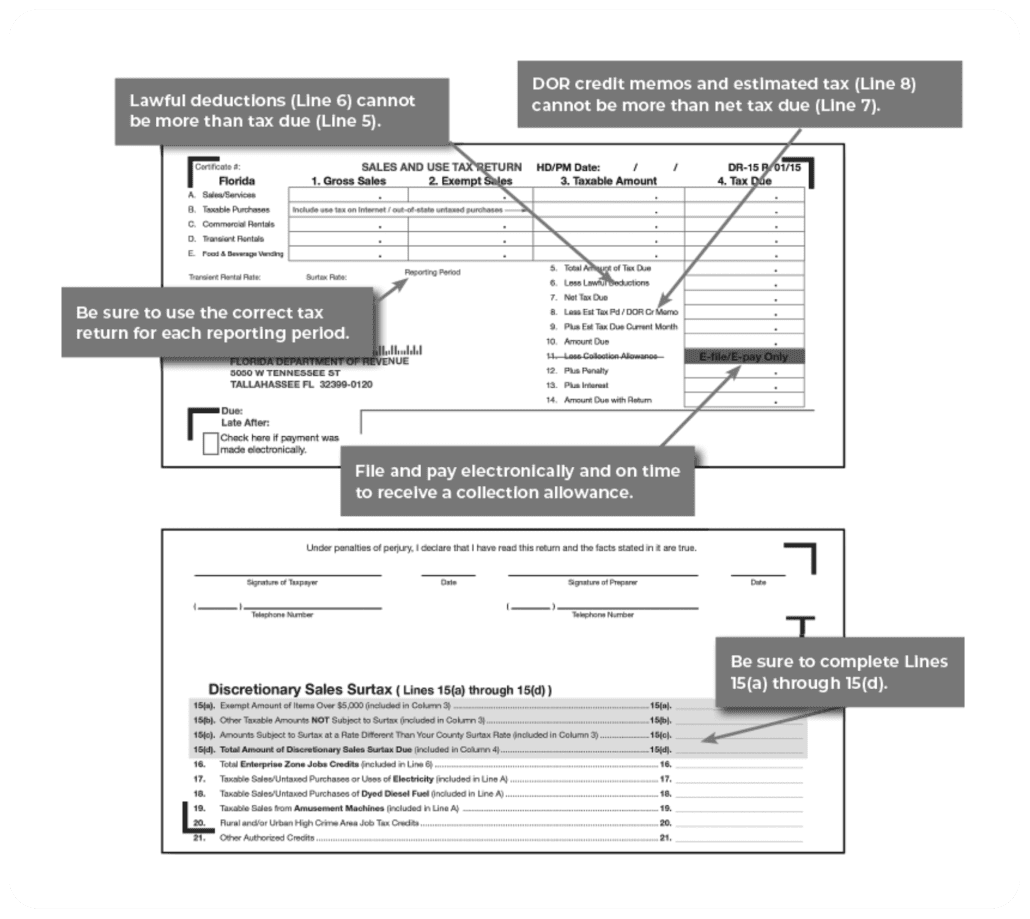

Counties and cities can charge an additional local sales tax of up to 15 for a maximum. SB 126 championed by Sen. Sales tax dealers must collect both discretionary sales surtax and the state sales tax from the purchaser at the time of sale and remit the taxes to the Florida Department of Revenue.

Have exceptional credentials and are well-versed in FL tax law have been. Rates include state county and city taxes. The 75 sales tax rate in Tampa consists of 6 Florida state sales tax and 15 Hillsborough County sales tax.

Florida has a 6 statewide sales tax rate but also has 368 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1036 on top. Convention hotels located in a. 31 rows The latest sales tax rates for cities in Florida FL state.

How to Calculate Florida State Sales Tax.

New Lexus Rx For Sale In Tampa Fl

Florida Sales Tax For Nonresident Car Purchases 2020

Appliances And Mattresses In Tampa Brandon And St Petersburg Fl Famous Tate

Florida Sales Tax Quick Reference Guide Avalara

2022 Tax Free Weekend In Florida For School Supplies July 25 To August 7

How To Report Florida Sales Tax Xendoo

Tampa Bay Ranked No 4 In The U S For Net Inflow Of Residents In 2020 Tampa Bay Business Journal

Florida Car Sales Tax Everything You Need To Know

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Florida Sales Tax Bracket System

Used Cars For Sale In Tampa Fl Cars Com

2021 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Certified Pre Owned Cars For Sale Tampa Certified Used Trucks Tampa

What Is The Hillsborough County Sales Tax The Base Rate In Florida Is 6

Hillsborough Could Have Florida S Highest Sales Tax After The Nov 6 Election Will It Matter

Used Sports Cars In Tampa Fl For Sale

Infiniti Q60 Vehicles For Sale Infiniti Tampa Fl

Used 2020 Jeep Wrangler Sahara For Sale In Tampa Fl 1c4hjxen9lw327611